Grow Profits And Your Wealth.

We develop tax strategies for optimal savings and money in your pocket.

We take a proactive approach to tax planning and strategy.

We account for all your variables to take the stress out of the process.

Unlike traditional CPAs, The Tax Saving Experts works with you throughout the year.

We change with your business needs throughout the year that pay off big during tax season.

Tax Planning

Planning is the key to successfully and legally reducing your tax liability. We go beyond tax compliance and proactively recommend tax saving strategies to maximize your after-tax income.

Tax Preparation

Without a deep understanding of the various tax laws, it is easy to make a mistake when filing your taxes. Lindholm + Company will make sure your filed taxes are correct and compliant so you avoid an IRS audit down the road.

CFO Services

Lindholm + Company manages your cash and risks and can act as a part-time CFO. Our CFO service gives you a professional financial manager who works with you to guide your business to success.

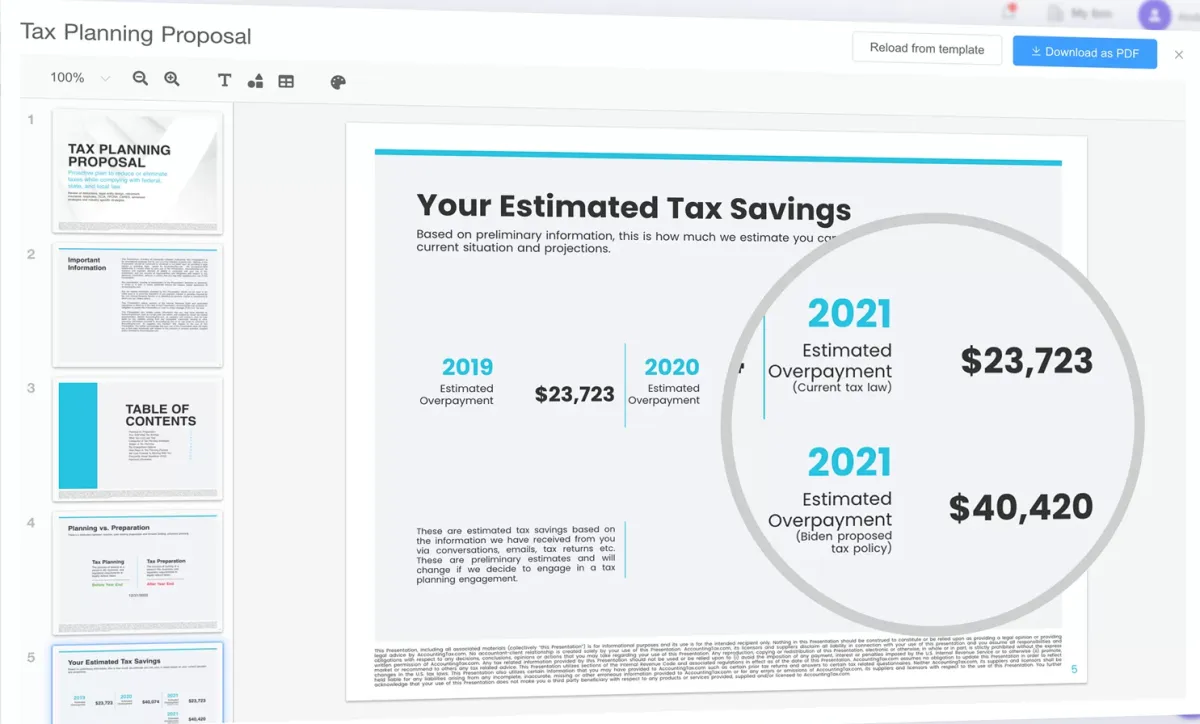

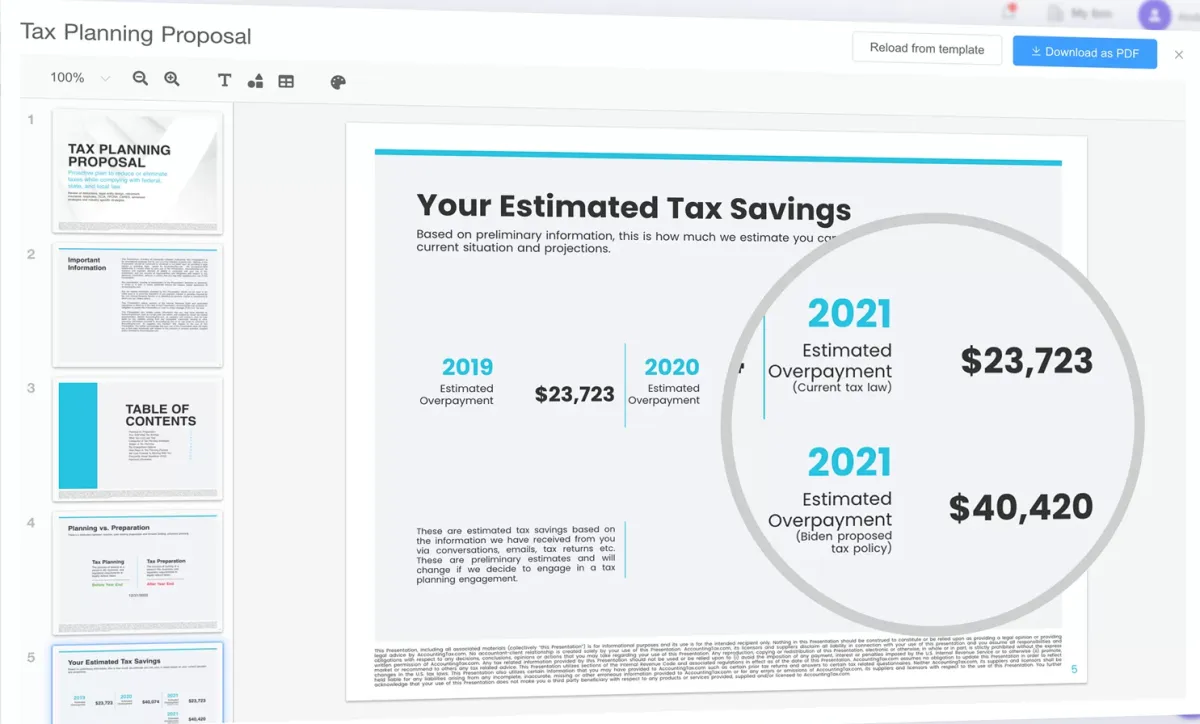

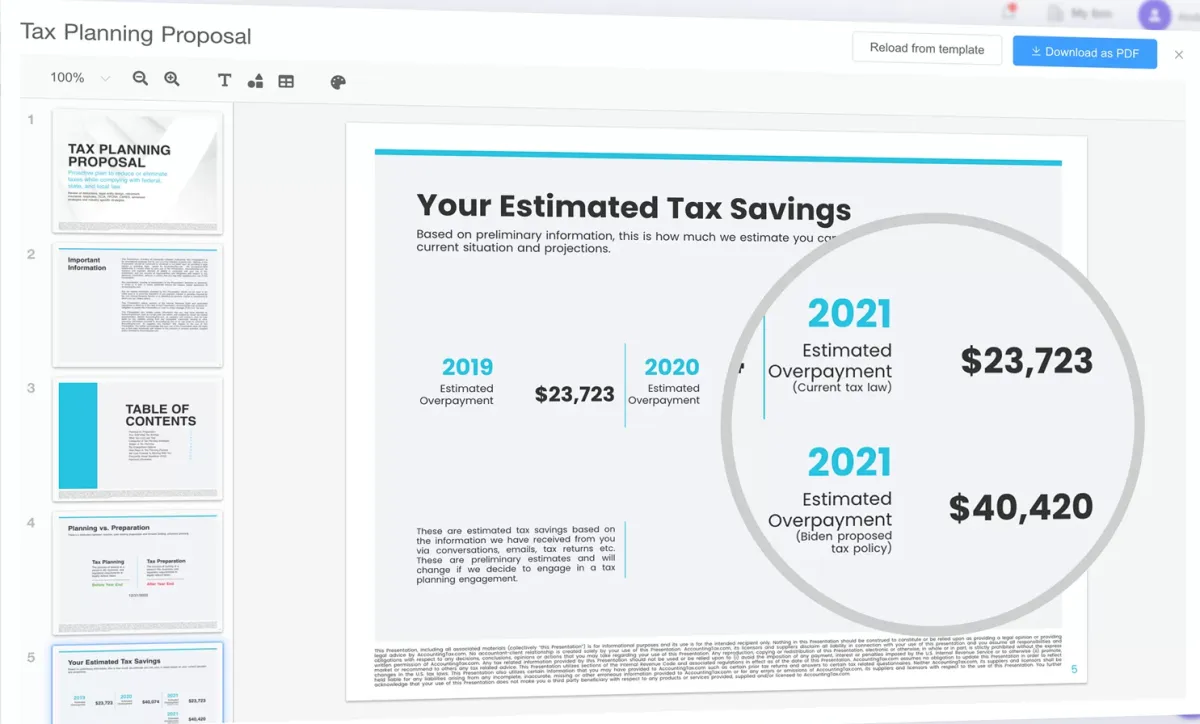

Your local accountant could be costing you thousands in taxes.

Lindholm + Company is licensed in all 50 states and offers experienced tax and accounting services within reach of average businesses. Our team legally and aggressively reduces tax liability, develops advanced tax strategies, and creates wealth for small business owners. Additionally, we can work with you to pay the bills, send out and collect on invoices, manage cash flow and build long-term tax plans.

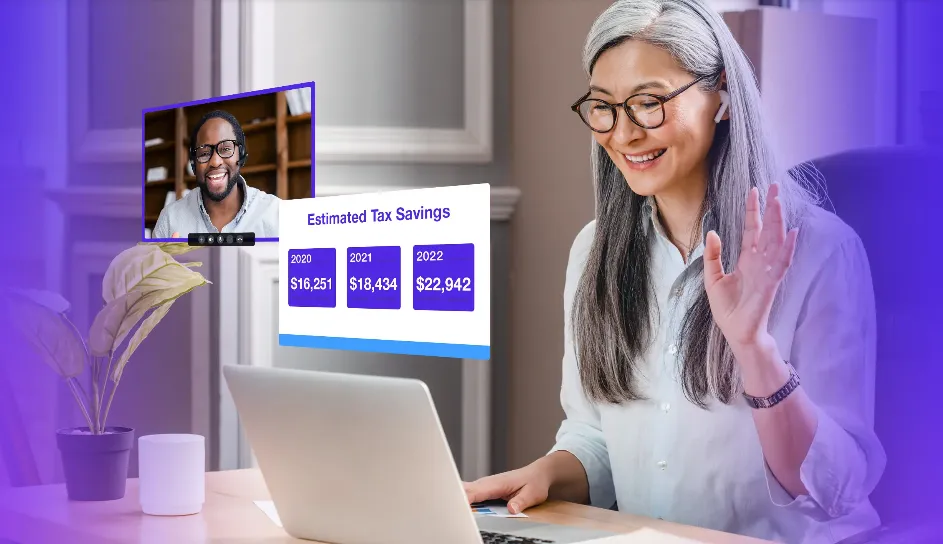

What if you stopped waiting till tax time — and started taking proactive action to reduce your taxes?

It's time to stop overpaying in taxes

...and access the secrets the 1% use to keep their money and build wealth.

The average business owner we speak with are missing out on $101,705 in tax deductions.

Nathan has been doing our taxes, business and personal, for 5+ years. Fee's are competitive and he provides more value than any of the prior CPA's I've worked with. He helps us with unique tax savings strategies throughout the year.

_

Chris S.

They revealed some loopholes in the taxing process, which was completely legal, and most importantly, helpful for me! They really are pros..

_

Max S.

Hi, I'm Nathan Lindholm, CPA

Meet Nathan Lindholm, also known as "The Tax Saving Expert." As a certified public accountant turned entrepreneur, Nathan is passionate about helping small business owners minimize their tax liabilities through proactive tax planning and strategy. His love for accounting began in high school, where he took his first accounting class, and he went on to earn a B.Sc. in Accounting and a minor in Economics from The Ohio State University.

Over the years, Nathan has gained extensive experience in different areas of accounting, including public accounting, governmental auditing for local governments in Ohio, corporate America with a Fortune 500 company, and small business. As a CPA, he began freelancing to help business owners in various industries with their accounting and taxes.

Today, Nathan and his team specialize in working with a range of industries, including construction, medical, realtors, franchises, investors, and service professionals. They offer exceptional service, expertise, and knowledge to help their clients keep more of their hard-earned cash while achieving their business objectives. Whether you're looking to optimize deductions or implement tax-reducing strategies, Nathan and his team are here to help.

Hi, I'm Nathan Lindholm, CPA

Nathan Lindholm, aka “The Tax Saving Expert", is a certified public accountant turned entrepreneur focused on helping small business owners lower their tax liability through proactive tax planning and strategy to keep more cash in their pockets. His love for accounting began in high school, when he took his first accounting class. He graduated from The Ohio State University with a B. Sc. in accounting and a minor in economics. Before founding Lindholm + Company, Nathan experienced every possible avenue of accounting, including public accounting, governmental auditing for local governments in Ohio, corporate America with a Fortune 500 company, and small business. Throughout that time, he became a CPA and began freelancing to help business owners in different industries with their accounting and taxes. After years of working for large accounting firms and at a Fortune 500 company, he returned to his first love, entrepreneurship, and opened his own firm. His goal has been to bring his experience, knowledge and expertise to clients in a valuable way. He's teamed up with some of the greatest minds in the legal, financial planning and accounting fields to bring his clients advanced tax strategies and planning. His clients benefit from time-tested, advanced strategies that most tax preparer's have never heard of. Today, he works with health and fitness business owners and entrepreneurs to solve problems through maximizing deductions and implementing tax-reducing strategies.

Permanently reduce your taxes today.

WHO THIS IS FOR

WE HELP PEOPLE IN ALL INDUSTRIES

_

Construction

_

Medical

_

Realtors

_

Franchises

_

Investors

_

Service Pros

Start saving today.

Contact us today to start planning your future.

INCOME DISCLAIMER: This website and the items it distributes contain business strategies, marketing methods and other business advice that, regardless of referenced results and experience, may not produce the same results (or any results) for you. Lindholm & Company makes absolutely no guarantee, expressed or implied, that by following the advice or content available from this web site you will make any money or improve current profits, as there are several factors and variables that come into play regarding any given business. Primarily, results will depend on the nature of the product or business model, the conditions of the marketplace, the experience of the individual, and situations and elements that are beyond your control. As with any business endeavor, you assume all risk related to investment and money based on your own discretion and at your own potential expense.

LIABILITY DISCLAIMER: By reading this website or the documents it offers, you assume all risks associated with using the advice given, with a full understanding that you, solely, are responsible for anything that may occur as a result of putting this information into action in any way, and regardless of your interpretation of the advice. You further agree that Lindholm & Company, its affiliates, subsidiaries, officers and agents, cannot be held responsible in any way for the success or failure of your business as a result of the information provided. It is your responsibility to conduct your own due diligence regarding the safe and successful operation of your business. In summary, you understand that we make absolutely no guarantees regarding income as a result of applying this information, as well as the fact that you are solely responsible for the results of any action taken on your part as a result of any given information. In addition, you agree that our content is to be considered “for entertainment purposes only”. Always seek the advice of a professional when making legal, financial, tax, or business decisions.

BUSINESS OPPORTUNITY: All products and services offered by Lindholm & Company are intended to provide prospective purchasers with general business strategies, marketing methods and other general advice for business development and training. At no point is Lindholm & Company soliciting anyone to enter into a new business nor is it representing, either expressly or by implication, that it will provide locations for a business, provide outlets, accounts, or customers, or purchase any of the goods or services made by the purchaser.

The products being offered through this promotion are packages of informational tools to help you learn about business and deal making strategies.

This site or product is not part of or endorsed by Facebook, Google, or any social media platform in any way.

FACEBOOK is a trademark of META PLATFORMS, Inc. YOUTUBE and GOOGLE are trademarks of ALPHABET, Inc.

Absolutely nothing on this web page should be considered as any type of earnings claim for what you will earn simply by joining.

The testimonials, figures, and screenshots on this page are real but they are displaying exceptional results from our best customers. These results are not typical. They are not intended to guarantee, promise or represent that you will get the same result just by signing up.

This will require work and you will be the ultimate person responsible for taking action and making sure you get the results that you want.

No part of this report may be reproduced or placed on any electronic medium without written permission from the publisher.

Information contained herein is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed.